2025 Tax Calculator For Senior Citizens In Usa

2025 Tax Calculator For Senior Citizens In Usa. Use our united states salary tax calculator to determine how much tax will be paid on your annual salary. Find the 2025 (for money you earn in 2025).

Estimate your tax bill or refund with our free federal income tax calculator. Curious whether you’ll owe taxes or get money back in april 2025?

2025 Tax Calculator For Senior Citizens In Usa Images References :

Source: agnesehjkmarguerite.pages.dev

Source: agnesehjkmarguerite.pages.dev

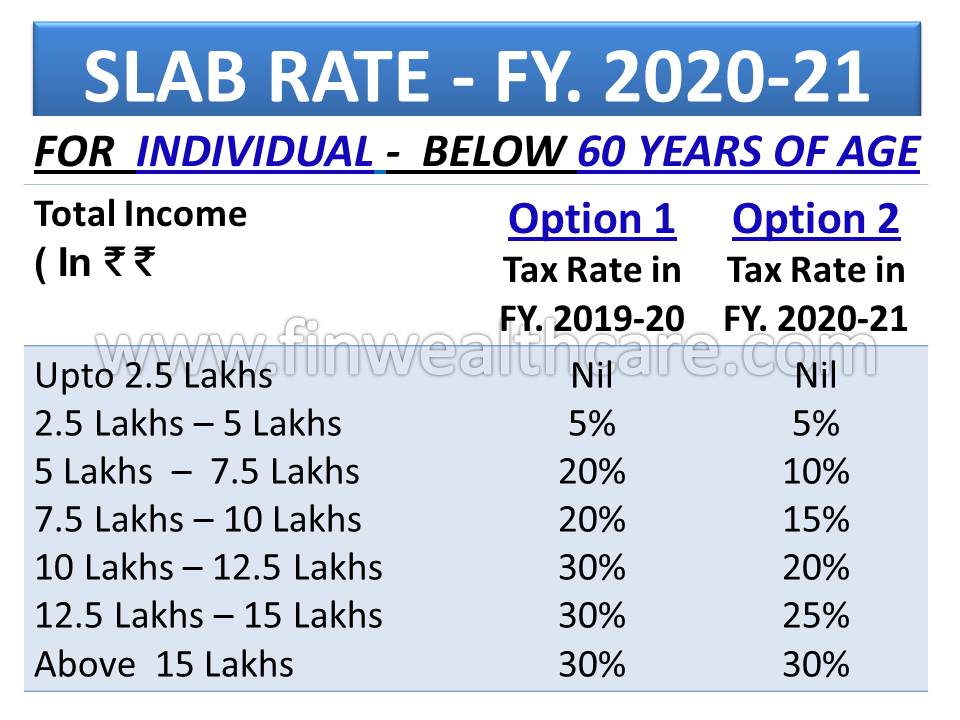

2025 Tax Brackets And Standard Deduction For Seniors Allsun Merrily, Enter your income and location to estimate your tax burden.

Source: cameronbaker.pages.dev

Source: cameronbaker.pages.dev

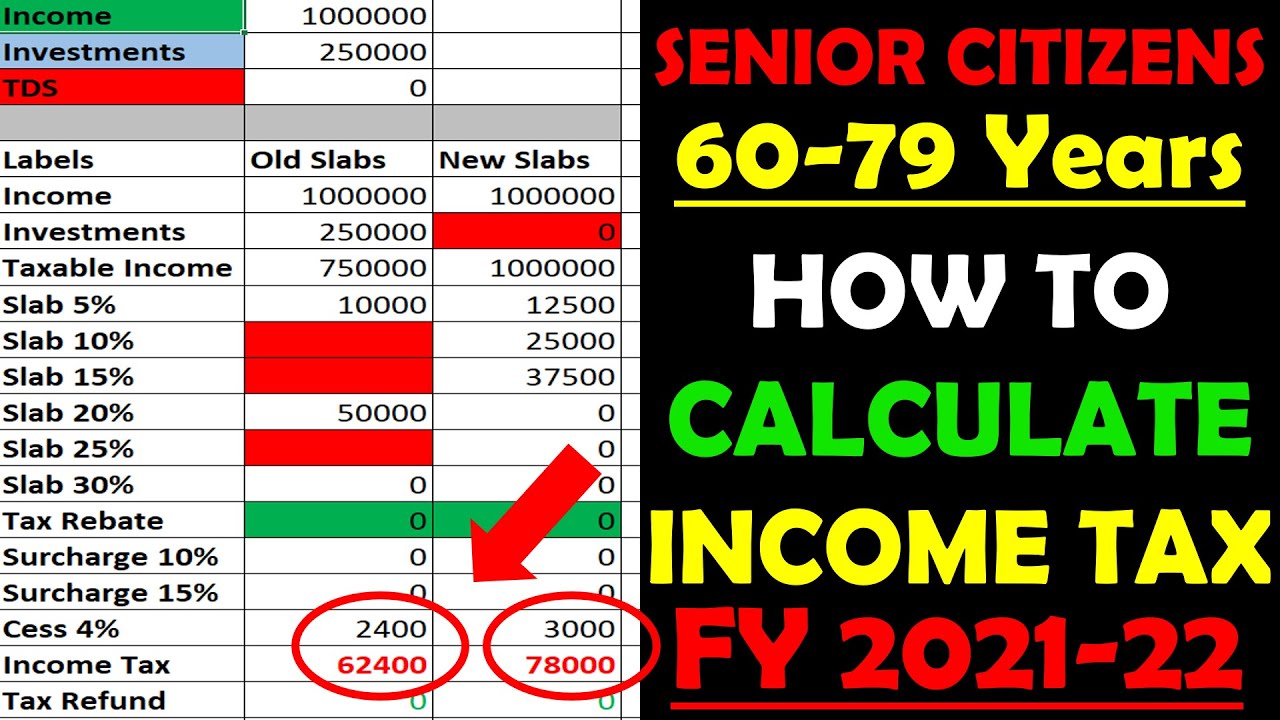

Senior Citizen Tax Slab For Fy 202524 Cameron Baker, Find the 2025 (for money you earn in 2025).

Source: amalrayne.pages.dev

Source: amalrayne.pages.dev

Tax Calculator Ay 202525 Excel Amal Rayne, The federal income tax has seven tax rates in 2025:

Source: othavhildagarde.pages.dev

Source: othavhildagarde.pages.dev

Tax Brackets 2025 Calculator Usa Rhona Cherrita, This means that you get a full federal tax calculation and clear.

Source: claralayla.pages.dev

Source: claralayla.pages.dev

New Regime Tax Calculator Ay 202525 Clara Layla, Use this calculator to estimate your total taxes as well as your tax refund or the amount you will owe in taxes.

Source: tobeasedominique.pages.dev

Source: tobeasedominique.pages.dev

Tax Refund Estimator 2025 2025 Meara Paloma, The federal income tax has seven tax rates in 2025:

Source: aylaharper.pages.dev

Source: aylaharper.pages.dev

2025 Tax Brackets Married Filing Separately Married Ayla Harper, Up to 10% cash back calculate your federal taxes with h&r block’s free income tax calculator tool.

Source: www.youtube.com

Source: www.youtube.com

How To Calculate Tax FY 202122 Excel Examples Senior Citizens, The new 2025 tax brackets reflect a 2.8 percent increase—much smaller than previous years.

Source: oliviaamal.pages.dev

Source: oliviaamal.pages.dev

Irs Tax Bracket Married Filing Jointly 2025 Olivia Amal, Use our united states salary tax calculator to determine how much tax will be paid on your annual salary.

Source: jamestaylor.pages.dev

Source: jamestaylor.pages.dev

Federal Tax Brackets 2025 Mfj James Taylor, For 2025, the standard deduction will rise by $400 to $15,000 for single filers, $800 to $30,000 for married couples filing jointly, and $600 to $22,500 for heads of household.

Category: 2025